Assets

Asset Management

Managing assets efficiently is a crucial part of maintaining a business's financial health and operational readiness. Ace CBM’s asset management tools provide a streamlined and intuitive way to track, organize, and oversee assets throughout their lifecycle.

Adding a New Asset

![![add asset]https://i.postimg.cc/DfL0Xc4X/Add-Asset.png](https://i.postimg.cc/DfL0Xc4X/Add-Asset.png) Follow these steps to create a new asset in Ace CBM:

Follow these steps to create a new asset in Ace CBM:

-

Access the Asset Form:

- In the Ace CBM dashboard, navigate to the "Asset/Bank" section and select "Add New Asset." The Asset New form will appear.

-

Fill in Asset Details:

- Asset Name: Enter a descriptive name for the asset (mandatory).

- Asset Type: Choose the category/type of asset from the dropdown menu (mandatory).

- TDS ID: Select the Tax Deducted at Source (TDS) ID if applicable.

- Reference Item ID: Enter a reference ID associated with the asset, if relevant.

- List Price: Input the original purchase price of the asset.

- HSN Code: Specify the Harmonized System of Nomenclature (HSN) code for tax classification.

- Balance: Add the current financial balance associated with the asset.

- Estimated Salvage Value: Provide the asset’s estimated residual value at the end of its useful life.

- Life (Months): Enter the expected lifespan of the asset in months.

-

Location Information:

- Unit: Select the unit or branch where the asset is located (mandatory).

- Location ID: Specify the unique ID for the asset’s location.

- Aisle/Bin: Enter additional details about the specific storage location, if applicable.

-

Depreciation Information:

- Depreciation Rate: Specify the rate of depreciation for the asset.

- Depreciation Calculation Interval: Choose the interval (e.g., monthly, yearly) for calculating depreciation.

- Depreciation Method: Select the method of depreciation (e.g., straight-line, declining balance).

- Depreciation Start Date: Enter the date from which the asset’s depreciation begins.

- Account Depreciation Account ID: Provide the account ID for depreciation tracking.

-

Additional Asset Details:

- Job Work: Indicate whether the asset is used for job work (Yes/No).

- Active: Specify if the asset is currently active (default is "Yes").

- Is Ineligible ITC: Mark whether the asset is ineligible for Input Tax Credit (Yes/No).

- Purchase GST Payable to Govt: Specify if GST is payable for the asset purchase (Yes/No).

- Tax Group ID: Input the tax group ID applicable to the asset.

- Note: Add any additional remarks or information about the asset.

-

Save the Asset:

- Verify that all details are entered correctly.

- Click on the Create button to save the new asset in the system.

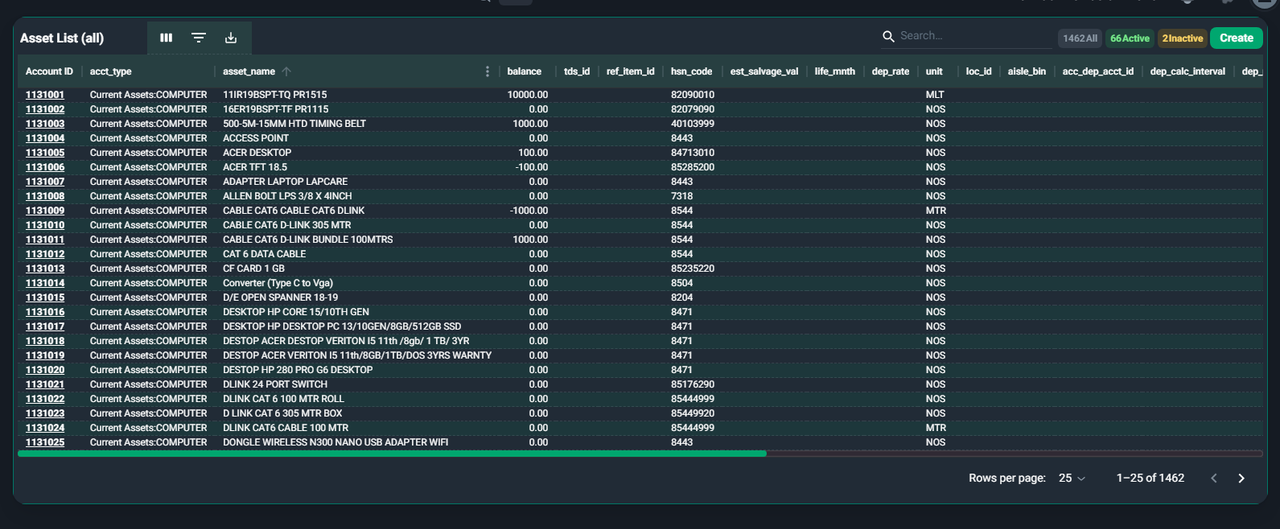

Asset List

Ace CBM’s Asset List provides a centralized view of all assets, allowing users to efficiently manage and monitor their asset inventory. The list is equipped with advanced filtering, search, and organizational features, enabling streamlined access to asset details and status.

Viewing the Asset List

-

Access the Asset List:

- Navigate to the Asset/Bank section in the Ace CBM dashboard and select Asset List. The full list of assets will be displayed, including active and inactive assets.

-

Filter by Status:

- At the top of the screen, use the status filters:

- All: Displays all assets in the system.

- Active: Shows only active assets currently in use.

- Inactive: Displays assets marked as inactive or retired.

- At the top of the screen, use the status filters:

-

Search for an Asset:

- Use the Search Bar at the top right to locate specific assets by typing in keywords like the Asset Name, Account ID, or other identifying attributes.

-

Review Asset Information:

- Each row in the table provides detailed information for individual assets, including:

- Account ID: The unique identifier associated with the asset account.

- Asset Type: The category or classification of the asset (e.g., current assets, fixed assets).

- Asset Name: The name or description of the asset.

- Balance: The financial balance or value of the asset.

- TDS ID: The associated Tax Deducted at Source ID.

- Reference Item ID: Reference ID linked to the asset.

- HSN Code: Harmonized System of Nomenclature code for tax classification.

- Depreciation Rate: The rate at which the asset depreciates.

- Unit: The unit or branch where the asset is located.

- Location ID: The specific location identifier for the asset.

- Aisle/Bin: The physical storage location within a warehouse, if applicable.

- Active Status: Indicates if the asset is currently in use.

- Each row in the table provides detailed information for individual assets, including:

-

Customize Display Options:

- Adjust the Rows per Page setting at the bottom of the screen to control the number of assets displayed at once.

- Use the pagination controls to navigate through the list if you have a large volume of assets.

-

Export Asset Data:

- Click the Export button (typically represented by a download icon) to export the list into a file format for external analysis or record-keeping.