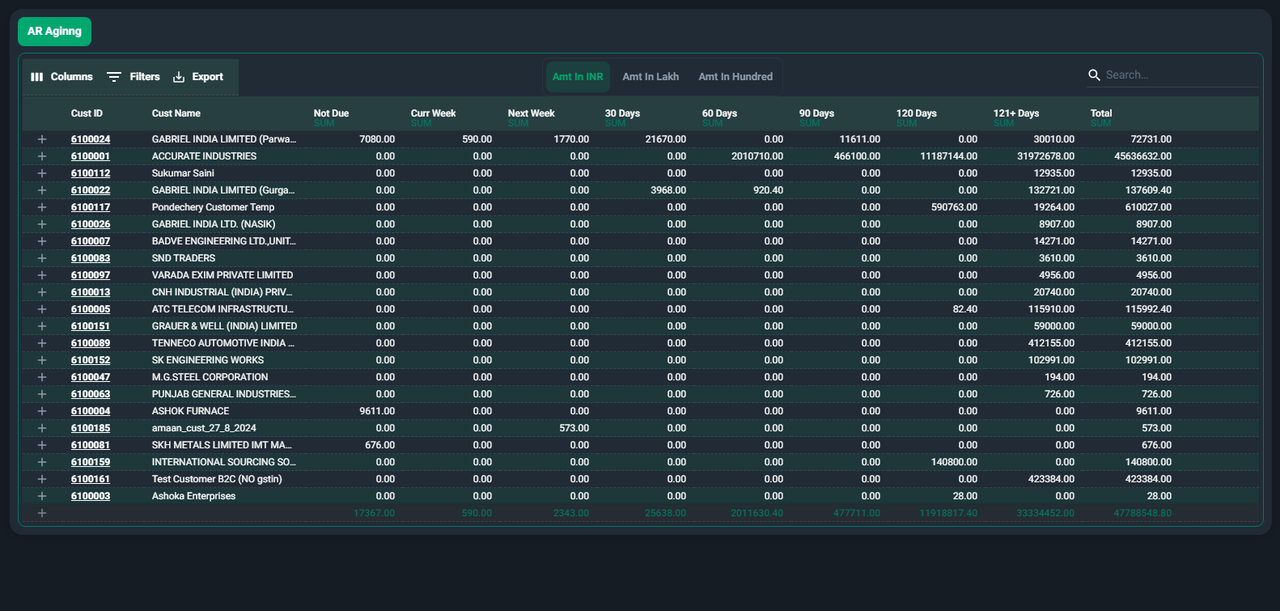

Accounts Recievable Aging

The Accounts Receivable (AR) Aging report in Ace CBM provides a comprehensive view of outstanding customer invoices and the duration they have been due. This tool is crucial for businesses to monitor overdue payments, assess credit risks, and maintain healthy cash flow.

Viewing the AR Aging Report

-

Access the AR Aging Report:

- Navigate to the AR Aging section from the Ace CBM dashboard. The AR Aging report will display a detailed table of customer accounts and their outstanding balances.

-

Understand the Report Layout:

- The report is structured to show customer balances categorized by due date intervals:

- Not Due: Outstanding invoices that are not yet due.

- Current Week: Payments due within the current week.

- Next Week: Payments due in the upcoming week.

- 30 Days, 60 Days, 90 Days, 120 Days, 121+ Days: Overdue payments categorized based on how many days past due they are.

- Total: Sum of all outstanding amounts for each customer.

- The report is structured to show customer balances categorized by due date intervals:

-

Filter and Sort Options:

- Use the Columns and Filters options at the top of the report to customize the data view.

- Apply filters based on specific customers, due dates, or amounts to focus on relevant data.

-

Search for Specific Customers:

- Use the Search Bar to locate customer accounts by name or customer ID.

-

Export the Report:

- Click the Export button to download the report for further analysis or sharing with stakeholders. The report can be exported in multiple formats, depending on your needs.

-

Currency View Options:

- Toggle between different currency views such as INR, Lakh, or Hundred to adjust the scale of the monetary values displayed.

The AR Aging report in Ace CBM ensures that businesses have a clear and actionable view of their accounts receivable, making it easier to manage collections and maintain financial stability.

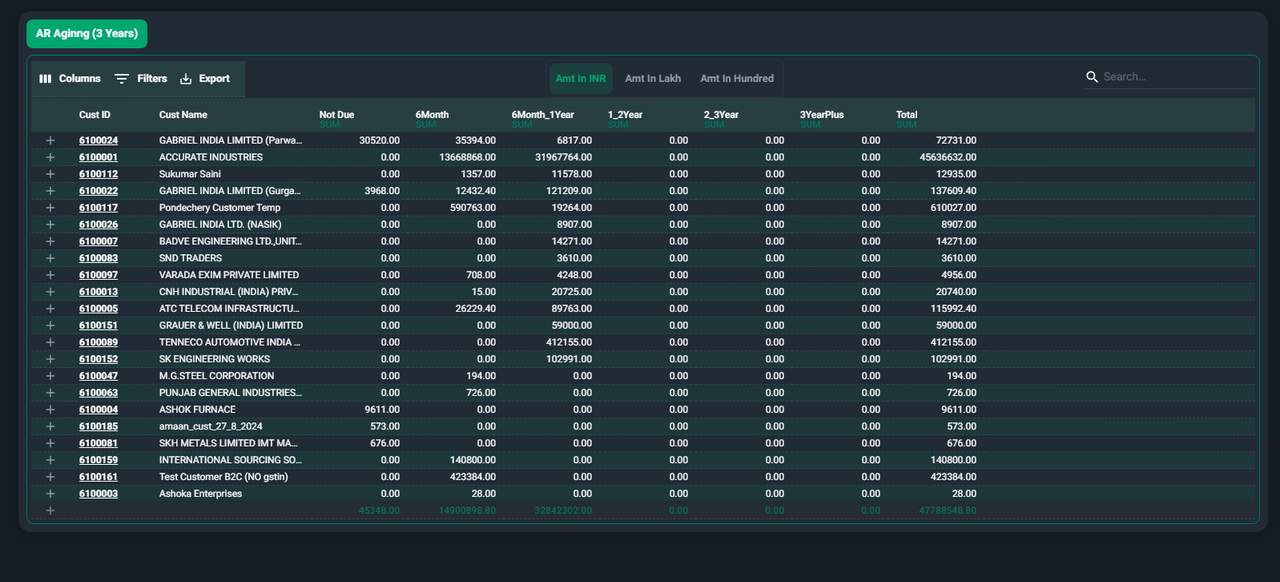

Viewing the AR Aging (3 Years) Report

-

Access the AR Aging (3 Years) Report:

- Navigate to the AR Aging (3 Years) section from the Ace CBM dashboard. The report will display all customer accounts with receivables categorized by age.

- Navigate to the AR Aging (3 Years) section from the Ace CBM dashboard. The report will display all customer accounts with receivables categorized by age.

-

Understanding the Report Layout:

- The report organizes receivables into time-based categories:

- Not Due: Invoices that are still within their payment terms.

- 6 Months: Payments due within the last 6 months.

- 6 Months - 1 Year: Receivables overdue for 6 months to 1 year.

- 1 - 2 Years: Receivables overdue between 1 and 2 years.

- 2 - 3 Years: Payments overdue for 2 to 3 years.

- 3 Years Plus: Payments overdue for more than 3 years.

- Total: The cumulative sum of all outstanding amounts for each customer.

- The report organizes receivables into time-based categories:

-

Filter and Sort Options:

- Use the Columns and Filters options at the top of the screen to refine the data displayed.

- Apply filters based on specific customers, time intervals, or amounts for targeted analysis.

-

Search for Specific Customers:

- Use the Search Bar to locate a particular customer or account by name or ID.

-

Export the Report:

- Click the Export button to download the report for offline review or sharing with team members. Available export formats allow for easy integration into other financial workflows.

-

Currency View Options:

- Switch between different monetary scales, such as INR, Lakh, or Hundred, for tailored visualization of the amounts.

The AR Aging (3 Years) report in Ace CBM is a critical tool for managing long-term receivables effectively, ensuring businesses maintain healthy financial practices and reduce bad debt risks.