Customer Payment

The Customer Payment feature in Ace CBM is a vital tool for managing and recording payments received from customers. It streamlines the process of tracking payments, applying credits, and managing advances, ensuring that all financial transactions are accurately recorded in the system. This functionality helps businesses maintain clear accounts receivable, monitor outstanding balances, and manage payment statuses efficiently. With built-in flexibility to allocate payments across multiple invoices or record them as advances, the tool ensures that businesses can handle diverse payment scenarios seamlessly. The Customer Payment module integrates with other financial records, providing real-time updates and comprehensive visibility into customer transactions, improving cash flow and financial accountability.

Adding a Customer Payment

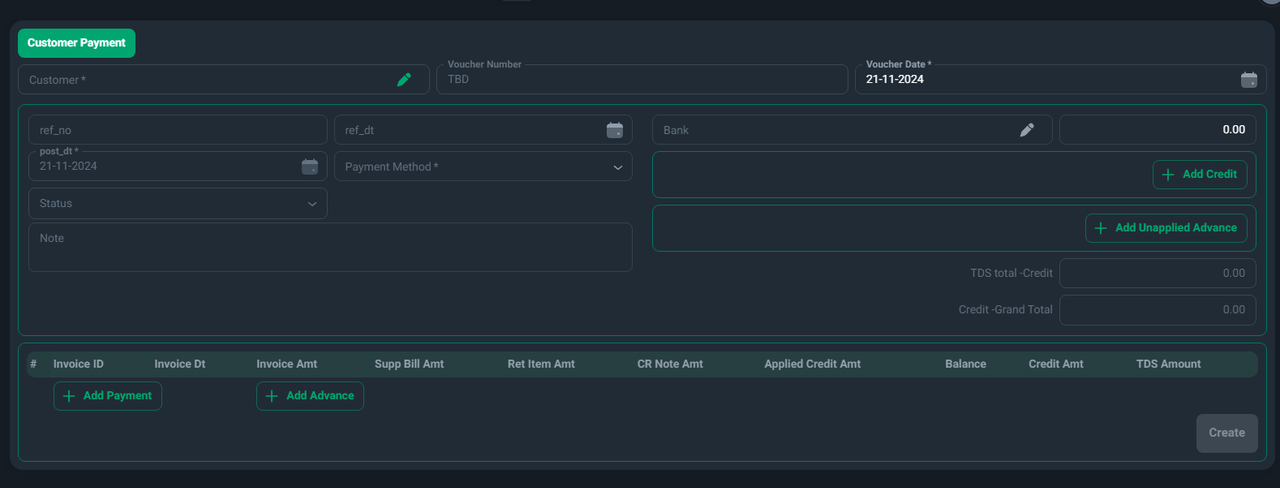

Follow these steps to add a new customer payment:

-

Access the Customer Payment Form:

- Navigate to the Customer Payment section in the Ace CBM dashboard. The form will appear as shown.

- Navigate to the Customer Payment section in the Ace CBM dashboard. The form will appear as shown.

-

Fill in Payment Details:

- Customer: Select the customer making the payment from the dropdown (mandatory).

- Voucher Number: The system will generate this automatically, or you can manually input a number if required.

- Voucher Date: Enter the date of the payment voucher (mandatory, defaulted to today’s date).

- Reference Number (ref_no): Add a reference number for the payment, such as a check or transaction ID.

- Reference Date (ref_dt): Enter the date associated with the reference number.

- Post Date (post_dt): Confirm the posting date of the payment (mandatory).

- Payment Method: Select the payment method (e.g., cash, bank transfer, credit card) from the dropdown (mandatory).

- Status: Set the status of the payment (e.g., pending, completed).

- Bank: Enter the bank name if the payment was made through a bank transfer or check.

- Note: Add any additional information or remarks regarding the payment.

-

Manage Credits and Advances:

- Add Credit: If the customer has unused credit, click Add Credit to apply it to the payment.

- Add Unapplied Advance: Include any previously recorded advance payments to adjust the total amount.

-

Allocate Payment to Invoices:

- In the table below, locate the customer’s outstanding invoices.

- Use the Add Payment button to allocate the payment to specific invoices by specifying the amount for each.

- Alternatively, use the Add Advance button if the payment is intended as an advance for future invoices.

-

Review and Calculate Totals:

- Review the TDS Total - Credit, Credit - Grand Total, and the applied amounts.

- Ensure that the balance matches the payment received.

-

Save the Payment:

- Verify that all details are correctly filled.

- Click Create to save the payment in the system.

Key Features of Customer Payment

- Flexible Allocation: Split payments across multiple invoices or record them as advances for future use.

- Credit Management: Apply available credits directly to outstanding invoices.

- Payment Transparency: Detailed fields ensure that payments are accurately linked to invoices or advances, reducing errors and disputes.

- Tracking and Audit: Maintain accurate records of payment details, including references and TDS amounts, for future reconciliation.

- Real-Time Updates: Payments automatically reflect in the accounts receivable and other linked modules, ensuring financial data is always up-to-date.

By leveraging the Customer Payment module, businesses can enhance their financial workflows, reduce manual effort, and ensure accuracy in managing customer payments and outstanding balances.

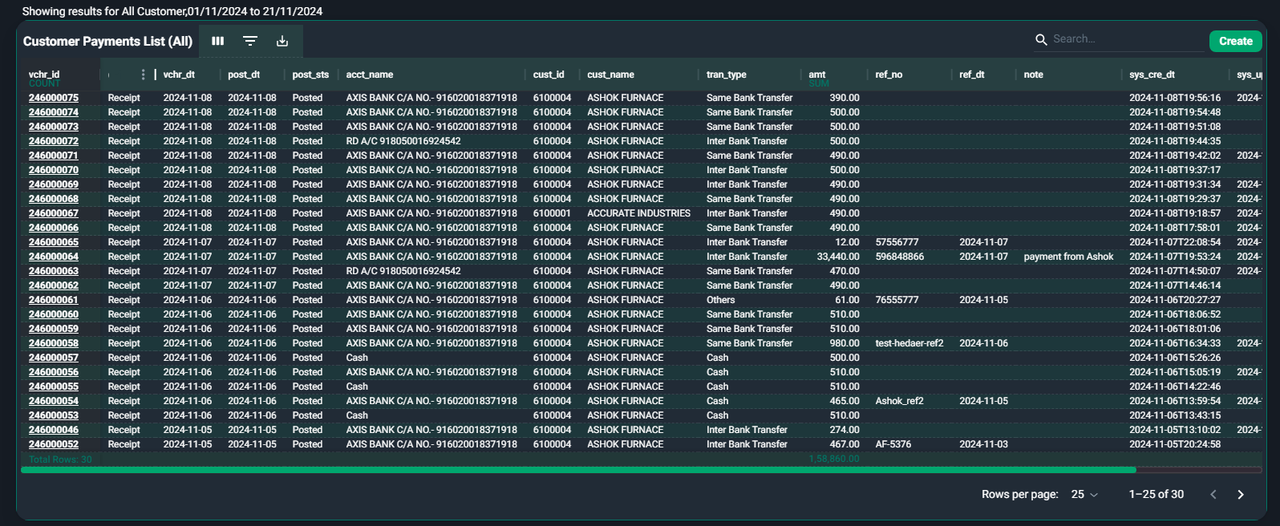

Customer Payment List

The Customer Payment List in Ace CBM provides a consolidated view of all recorded customer payments. It serves as a powerful tool for monitoring, auditing, and managing payment transactions across the organization. This feature enables users to track payment details, verify statuses, and ensure transparency in accounts receivable management.

Features of the Customer Payment List

-

Detailed Payment Records:

- The list displays essential details for every recorded payment, including:

- Voucher ID: A unique identifier for each payment entry.

- Voucher Date (vchr_dt): The date the voucher was issued.

- Post Date (post_dt): The date the payment was posted.

- Account Name: The bank or cash account associated with the payment.

- Customer ID and Name: Identifies the customer associated with the payment.

- Transaction Type: Indicates the payment method (e.g., cash, bank transfer).

- Amount: The payment amount received.

- Reference Number and Date: Any additional references for the payment (e.g., check number or transaction ID).

- Notes: Any specific remarks or details regarding the transaction.

- The list displays essential details for every recorded payment, including:

-

Payment Status:

- Status (post_sts): Reflects whether the payment is posted, pending, or voided, providing a clear picture of transaction progress.

-

Audit Trails:

- The list includes system-generated fields such as:

- Creation Date (sys_cre_dt): Indicates when the payment record was created.

- Update Date (sys_upd_dt): Tracks any changes or updates made to the record.

- User ID (sys_user_id): Identifies the user who performed the action.

- The list includes system-generated fields such as:

How to Use the Customer Payment List

-

Access the List:

- Navigate to the Customer Payments List section from the Ace CBM dashboard. The list will display all payment records by default.

- Navigate to the Customer Payments List section from the Ace CBM dashboard. The list will display all payment records by default.

-

Search for Specific Payments:

- Use the Search Bar to locate payments based on voucher ID, customer name, or transaction type.

-

Filter Payment Records:

- Apply filters using the Columns or Filters options to view specific sets of data, such as payments by a particular customer, payment status, or date range.

-

Sort and Customize Display:

- Sort records by clicking on column headers such as Voucher Date or Amount to organize data for easier analysis.

-

Export Payment Data:

- Use the Export button to download the payment list in a preferred format for further processing or sharing with team members.

-

Pagination and Row Settings:

- Adjust the Rows per Page setting at the bottom of the screen to control how many records are displayed at once.

- Navigate through the list using the pagination controls to access additional pages of payment records.

Ace CBM’s Customer Payment List is an indispensable tool for businesses, enabling efficient management of customer transactions and ensuring financial accuracy across accounts receivable.