Sales Invoice

Sales invoices are a critical component of business operations, serving as formal documentation of sales transactions, supporting revenue tracking, and ensuring accurate financial reporting. They establish clear payment terms, helping to minimize delays and maintain healthy cash flow. Ace CBM offers a comprehensive invoicing solution that streamlines invoice creation, management, and tracking. Through automated calculations, structured record-keeping, and advanced search and filter capabilities, Ace CBM enables businesses to manage their invoicing process with precision and efficiency, enhancing accuracy and reducing administrative burdens.

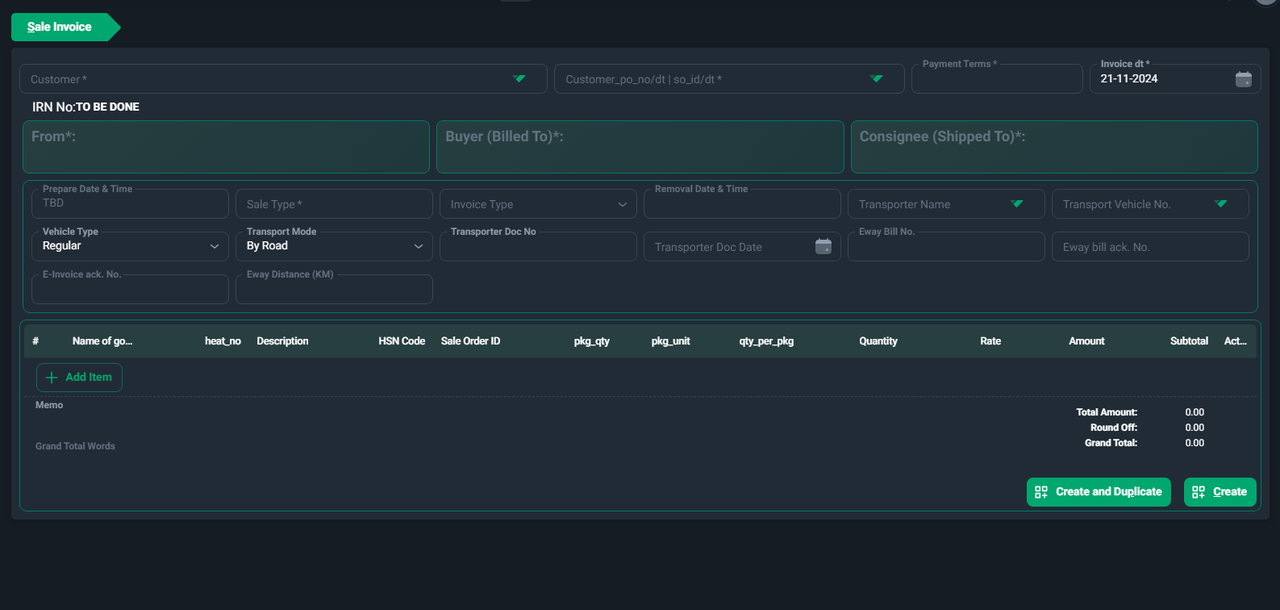

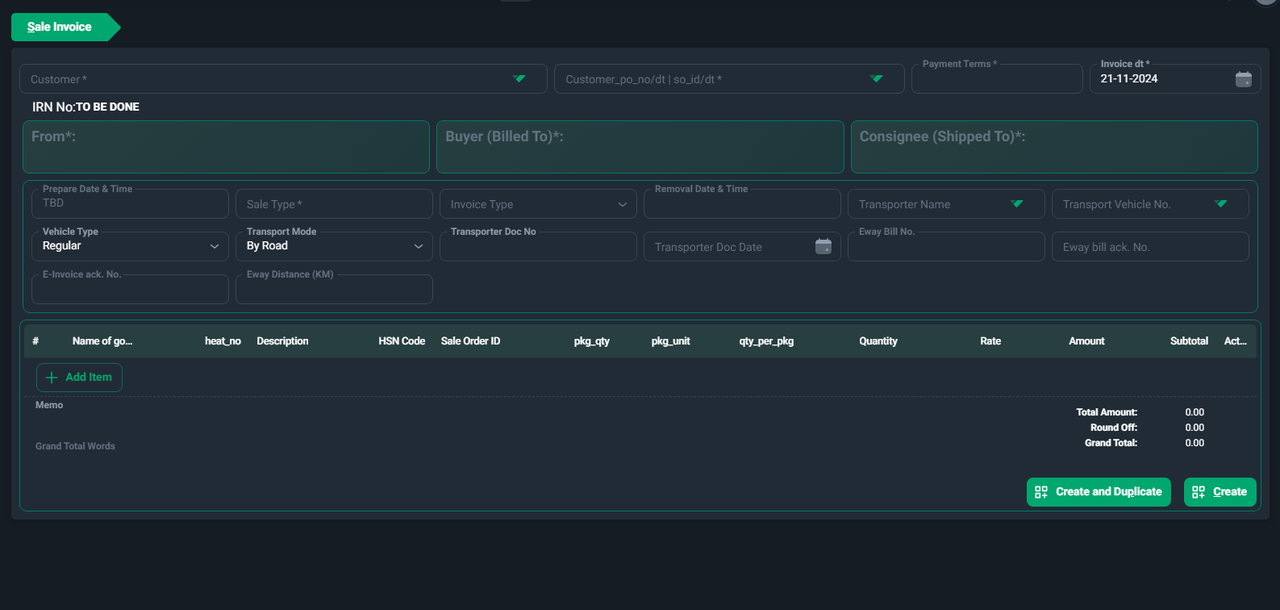

Steps to Create a Sales Invoice

-

Access the Sales Invoice Form:

- Navigate to the Sales Invoice section in the Ace CBM dashboard.

- Navigate to the Sales Invoice section in the Ace CBM dashboard.

-

Fill in Basic Details:

- Customer: Select the customer for whom the invoice is being created (mandatory).

- Customer PO No./Sales Order ID: Link the invoice to a specific Purchase Order (PO) or Sales Order, if applicable.

- Payment Terms: Specify the payment terms agreed with the customer.

- Invoice Date: Provide the date of the invoice (default is the current date).

-

Sender and Recipient Details:

- From: The sender’s details (your company information) will auto-populate.

- Buyer (Billed To): The details of the buyer will auto-populate based on the selected customer.

- Consignee (Shipped To): Enter the details of the consignee, if different from the buyer.

-

Transport and E-Invoice Details:

- Prepare Date & Time: Specify when the goods or services are prepared for dispatch.

- Sale Type: Select the type of sale (e.g., Regular, Export).

- Invoice Type: Indicate the type of invoice (e.g., Tax Invoice, Bill of Supply).

- Vehicle Type: Choose the type of vehicle used for delivery.

- Transport Mode: Specify the mode of transport (e.g., By Road, By Rail).

- Transporter Name: Select or input the name of the transporter.

- Transporter Document Number and Date: Provide the relevant document details, if applicable.

- E-Way Bill No.: Input the e-way bill number, if applicable.

- E-Invoice Acknowledgement No.: Enter the e-invoice acknowledgment number for GST compliance.

- E-Way Distance (KM): Specify the distance to the delivery location.

-

Add Items:

- Use the Add Item button to input the details of goods or services sold. For each item, provide:

- Name of Goods/Services: Description of the item or service.

- Heat No.: Add the heat number, if applicable.

- Description: Provide additional details about the item.

- HSN Code: Enter the Harmonized System of Nomenclature code for tax purposes.

- Sale Order ID: Link to the corresponding Sale Order ID.

- Package Quantity and Unit: Specify the number and unit of packages.

- Quantity per Package: Enter the quantity contained in each package.

- Rate and Amount: Input the rate and calculate the total amount for each item.

- The subtotal will be calculated automatically.

- Use the Add Item button to input the details of goods or services sold. For each item, provide:

-

Add Memo (Optional):

- Include any special instructions or notes related to the invoice in the Memo field.

-

Review and Finalize Totals:

- Check the Total Amount, Round Off, and Grand Total to ensure accuracy.

-

Save or Duplicate the Invoice:

- Click Create to save the invoice.

- Alternatively, click Create and Duplicate to save the invoice and use it as a template for creating a new one.

Sales Invoice List

The Sales Invoice List in Ace CBM offers a comprehensive and organized view of all generated sales invoices. This module allows businesses to track, analyze, and manage invoices effortlessly. With advanced filtering and export options, users can easily navigate through their invoices to monitor payment statuses, tax details, and customer transactions.

Features of the Sales Invoice List

-

Detailed Invoice Records:

- Each row provides essential information about individual invoices:

- Invoice ID: A unique identifier for the sales invoice.

- Invoice Date (invoice_dt): The date the invoice was created.

- Posting Date (post_dt): The date when the invoice was posted.

- Status: Indicates whether the invoice is "Posted," "Cancelled," or in another state.

- Voucher Type (vchr_type): Specifies the type of voucher (e.g., Sale, Supplementary Bill).

- Invoice Type: Defines the type of invoice (e.g., Finished Goods, Job Work Sale).

- Each row provides essential information about individual invoices:

-

Customer and Sales Details:

- Customer ID and Name: Identifies the customer associated with the invoice.

- Sale Type: Displays the type of sale (e.g., GST SALE CENTRAL 18%).

- Payment Terms: Specifies the terms agreed upon for the payment (e.g., 30 days, 60 days).

-

Taxation and Financial Details:

- Invoice Amount: Total amount of the invoice.

- Taxable Amount: The taxable value of the items or services.

- IGST, CGST, SGST, TCS: Breakdowns of applicable taxes for each invoice.

- Round-Off: Adjustments to the total invoice amount, if any.

-

Audit and System Fields:

- Creation and Update Dates: System-generated timestamps for record tracking.

- User ID: Identifies the user responsible for creating or updating the invoice.

-

Total Summary:

- Displays the sum of invoice amounts, taxable amounts, and tax values at the bottom of the list for quick insights.

How to Use the Sales Invoice List

-

Access the Sales Invoice List:

- Navigate to the Sales Invoice List section in the Ace CBM dashboard.

-

Search and Filter Options:

- Use the Search Bar to locate specific invoices by Invoice ID, Customer Name, or other attributes.

- Apply filters using the From Date and To Date fields to view invoices within a specific period.

- Use the Customer Filter to narrow the list to invoices for a specific customer.

-

Sort and Organize Data:

- Sort records by clicking on column headers, such as Invoice Date, Status, or Amount, for better visibility.

-

Switch Views:

- Use the Switch to Item View button to toggle between invoice-level details and item-level breakdowns.

-

Export the List:

- Click the Export button to download the sales invoice data for further analysis or sharing with team members.

-

Pagination and Row Display:

- Adjust the Rows per Page setting to control how many records are displayed at a time.

- Use pagination controls to navigate through the list if it spans multiple pages.

Ace CBM’s Sales Invoice List is an indispensable tool for businesses, providing a streamlined approach to managing sales invoices while ensuring transparency and operational efficiency.